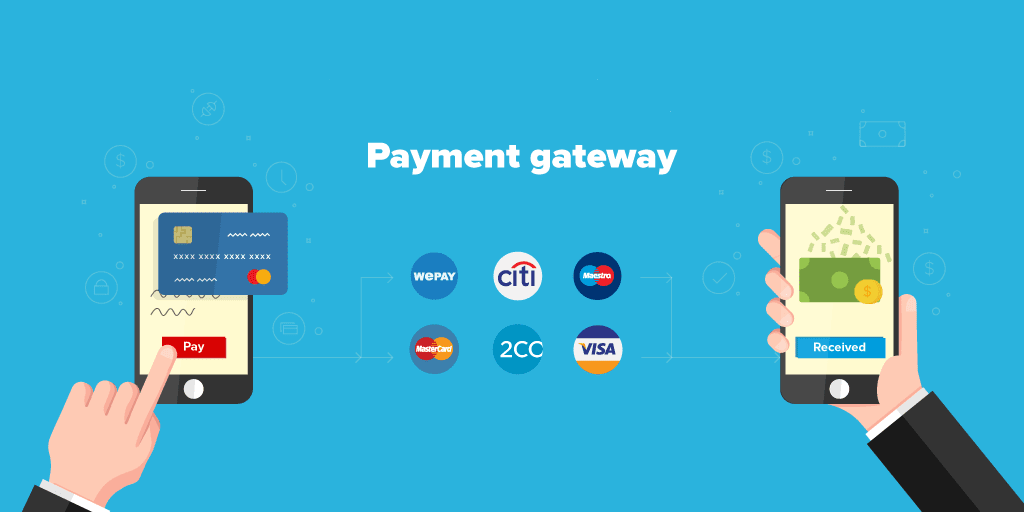

These days, people are getting used to the convenient way of online shopping. Therefore, eCommerce marketing is growing rapidly across the world. If you’re also thinking of setting up your online shopping website, then a payment gateway script should be on your priority list.

With a lot of payment gateway options available in the market that allow the customers to make payments, it could be a hassle for you to settle on the best payment processor script. Therefore, we have rounded up the 10 best payment gateway providers list that will provide you with a seamless money transfer experience.

Top 10 Best Payment Gateways providers List

Here goes our curated list of the Top 10 payment gateways:

PayPal

PayPal is a name that no longer needs an introduction. It is one of the most popular global payment gateways with an approach ability to over 200 countries across the world. Millions of store owners use it across the world. Recently, PayPal claims that it has touched down the mark of 173 million customers who use PayPal daily to make payments.

PayPal is a free-to-use money transfer script for buyers, however, sellers will have to pay a 4.4.% fee per transaction along with the fixed amount, the fixed amount varies from country to country. PayPal doesn’t require any financial information to send and receive payments. All it requires is an email address to send and receive payments instantly.

Key Features:

- Accept international payments through debit and credit card

- Simplify PCI compliance

- Great Customer support

- No withdrawal fee

- Availability on both Android and iOS smartphones

Stripe

Stripe is a U.S based cloud-based payment gateway that helps to send and receive money throughout the world. It provides support for all major credit cards. Stripe emerged as the best solution for the people who own an eCommerce store, on-demand marketplace, or any other business which requires accepting payments online.

Being a robust payment processor script provider, Stripe ensures smooth transactions of funds and provides enhanced security to prevent fraudulent payment activities. Stripe operates on the Open API which means you can integrate the payment gateway with your business with no hassle.

Stripe has a transparent pricing structure. As a store owner, it will charge you 2.9% +$0.30 per transaction.

Key Features:

- Friendly Android and iOS user interface

- Wide payment options

- Open source plugin

- Machine learning fraud prevention techniques

- Real-time reporting

Authorize.Net

Authorize.net was established in 1996. It is one of the oldest and trustable global payment gateway providers. It provides the option to accept payment through all major debit and credit cards including Visa, Master, Discover, and so forth.

Authorize.Net can even accept the payments through electronic checks and transfer the funds to the bank account with immediate effects. It is equipped with an easy-to-use interface which makes it a splendid choice for both novice and experienced sellers.

Key Features:

- Simple checkout

- Improved security to prevent fraudulent activities

- Customer information manager

- Retail payment

Razorpay

Razorpay is a top payment gateway in India that allows eCommerce businesses to accept, process, and disburse payments with the help of its product suite. It provides you support to accept payments through all kinds of debit/credit cards, net banking, UPI, and wallets.

Razorpay doesn’t require any subscription fee, however, it charges you 2% of every successful transaction and 1% more on international payments.

Key Features:

- Zero wallet fee

- 24*7 customer support services

- Accept payments through international debit and credit card

- Mobile application available for both Android and iOS

2Checkout

2Checkout is another name in our list of top payment gateway providers. It has an approach ability to over 87 countries and allows eCommerce businesses to accept payments through all major debit and credit cards.

2Checkout has the standard prices, it will cost you 3.5% +$0.35 on every successful transaction

Key Features:

- Recurring bill

- Easy integration with over 100 online carts

- Wide payment options

Paytm

Paytm started its operations as the mobile & DTH recharge service and now it has become a $4 billion company. With Paytm, you can accept payment from multiple sources including debit/credit card, net banking, UPI, and so on.

The charges of the Paytm payment gateway vary, it charges 0.4% for below 2000 and 0.9% for an amount higher than 2000. However, startups or individuals can opt for its services at no cost.

Key features:

- Zero set up and maintenance cost

- Real-time bank settlement

- 24*7 customer support services

- Dedicated key account manager

DirecPAY

DirecPAY emerges as the convenient and faster payment gateway which enables businesses to seamlessly accept payment across the world.

It provides you with a cost-effective service with the protected technology. In exchange for its services, it will cost you a 2% transaction fee per transaction.

Key Features

- Zero maintenance cost

- Zero withdrawal fee

- Availability for both Android and iOS

- Supports international payments

InstaMojo

This is the top payment gateway providers, InstaMojo allows you to create a bank account instantly to collect payments without even a website. The gateway eases you with faster and secure payments.

InstaMojo will charge you a 2% +RS 3 transaction fee on every successful transaction made through the gateway.

Key Features:

- Zero maintenance charges

- Support all major eCommerce platforms

- Zero withdrawal fee

EBS

The EBS payment gateway is specially designed for eCommerce websites and is known for its advanced safety features.

The charges of the EBS payment gateway vary depending on the package you have selected. As standard, it will cost you Rs 2400 every year as annual maintenance charges.

Key Features:

- Zero setup fee

- Zero Withdrawal fee

- Mobile application available for both Android and iOS

CCAvenue

CCAvenue is another payment processor script provider that comes with plenty of payment options. It supports 27 major currencies along with 200+ payment options.

CCAvenue will cost you 2% on domestic transitions and 3% on international transactions along with the Rs 1200 annual maintenance fee.

Key Features:

- Zero withdrawal and set up fee

- 24*7 customer support services

- Mobile application availability

- Easy integration with all major eCommerce platforms

Conclusion

And with that, we have provided you with the 10 best payment gateway providers. However, if you’re looking for a custom payment gateway script or money transfer clone script, you should contact any of the leading payment gateway providers. They have expertise in developing custom payment gateways, including payment processor clones.